I am a Professor in the Finance section at Stockholm Business School, Stockholm University, doing research on financial market microstructure, with applications to asset pricing, financial econometrics, and liquidity measurement. I am a full-time visitor at Sveriges Riksbank (the Swedish central bank) from Oct 2025 to Aug 2026.

Market fragmentation in Europe

The European equity trading landscape of 2022 is a complex mix of exchanges, dark pools, dealers, and auctions. The once dominant national stock exchanges are now part of global exchange groups that compete with investment banks and high-frequency trading (HFT) firms to match the orders of retail and institutional investors. Is this diverse trading environment… Continue reading Market fragmentation in Europe

Symposium on Market Fragmentation in Europe

As dark pools, systematic internalisers, and periodic auctions capture large market shares in European equities trading, the market fragmentation (critics call it "hyperfragmentation") is widely debated. On May 4, 2022, I co-organized a symposium on this topic with the Swedish Securities Markets Association. The event featured presentations of recent academic papers about the effects of… Continue reading Symposium on Market Fragmentation in Europe

Overestimated effective spreads

Accurate liquidity measurement is important for liquidity timing and order routing. One of the most prevalent measures is the effective spread, defined as the percentage difference between the transaction price and the bid-ask spread midpoint. In a paper recently accepted for publication in Journal of Financial Economics, I challenge the use of the spread midpoint to gauge the fundamental value when measuring the effective spread. I show that the use of the midpoint leads to an overestimation of the “true” effective spread.

The Microstructure Exchange

I am one of the organizers for a new online seminar series in market microstructure -- The Microstructure Exchange. We plan to have academic webinars every Tuesday, featuring the latest research on financial market structure. For more information and registration, the website is at https://microstructure.exchange/

Robothandel och volatilitet

Stäng inte börsen

Jag skriver på DI Debatt (20 mars) att förslag om blankningsförbud och börsstängning som kommer nu i Covid19-krisen bör avvisas. Här lite extramaterial, som inte fick plats i tidningen. Bakgrund Blankningsförbud har den senaste veckan införts i Sydkorea, Spanien, Frankrike, Italien och Belgien (Bloomberg, FT) Jag har inte sett att någon börs stängt helt, men NYSE… Continue reading Stäng inte börsen

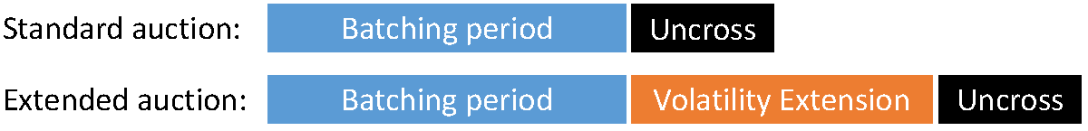

Auction volatility safeguards

At the opening of US equity markets on August 24, 2015, prices dropped sharply following overnight turmoil in global markets. In the minutes after opening, large order imbalances triggered circuit breakers to halt trading in numerous stocks and exchange-traded funds. More than a thousand securities were affected and hundreds of them experienced repeated trading halts… Continue reading Auction volatility safeguards

De la Vega Prize

Celebrating Campbell-Lo-MacKinlay

On May 4-5, together with Albert Menkveld I organized the Conference on the Econometrics of Financial Markets at Stockholm Business School. The conference celebrated the 20th anniversary of an influential book on financial econometrics, published in 1997 by John Campbell, Andrew Lo, and Craig MacKinlay. The conference featured keynote speeches by John Campbell and Andrew Lo,… Continue reading Celebrating Campbell-Lo-MacKinlay